Offices: Gurgaon, Jaipur, Indore, London, Dubai, Sweden

Tokenization of Property

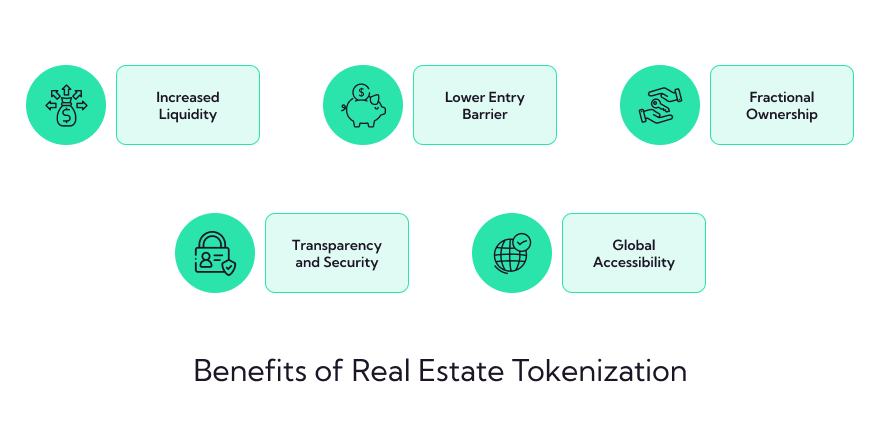

The world of real estate is undergoing a significant transformation, thanks to the advent of blockchain technology and the concept of tokenization. Traditional real estate investment has often been perceived as complex, illiquid, and inaccessible to many. However, the emergence of real estate tokenization has the potential to democratize access to property investments, making it more efficient, inclusive, and secure. In this article, we will explore the concept of tokenization of real estate, how it works, its benefits, key considerations, use cases, and the promising future it holds for the real estate industry.

What is tokenization of real estate?

Tokenization is the process of converting ownership rights of an asset into digital tokens that are recorded on a blockchain. In the context of real estate, tokenization involves dividing the ownership of a property into smaller fractional shares, which are then represented as digital tokens. These tokens are backed by the underlying property and can be traded on digital asset exchanges, providing investors with the opportunity to own a portion of high-value properties that were previously out of their reach.

How does real estate tokenization work?

Real estate tokenization involves several key steps:

Property Selection: A property is selected for tokenization, typically meeting certain criteria such as high value, income potential, and legal compliance.

Legal Structuring: Ownership rights to the property are converted into digital shares. These shares are then represented as tokens on a blockchain, often adhering to regulatory frameworks.

Token Creation: Tokens are generated for each fractional share. These tokens are unique and contain information about the property and the owner’s rights.

Investor Onboarding: Investors interested in the property can purchase these tokens, becoming fractional owners of the real estate asset.

Secondary Market Trading: Investors can trade their tokens on digital asset exchanges, providing liquidity to an otherwise illiquid market.

Key Considerations

Real estate tokenization, though promising, demands thorough consideration of critical aspects. Adhering to diverse regulations governing securities and real estate transactions across jurisdictions is pivotal to a successful tokenization process. The vulnerability of tokenized real estate asset values to market fluctuations, akin to traditional investments, underscores the importance of effective risk management strategies. Security concerns loom, as tokenized assets are susceptible to hacking and digital threats, warranting stringent protective measures. Moreover, the meticulous testing of smart contracts that oversee tokenized ownership is essential to minimize potential glitches or vulnerabilities.

Use Cases

Real estate tokenization has found application in various scenarios:

Fractional Ownership

Individuals can invest in premium properties with lower entry barriers, creating a new class of investors.

Real Estate Crowdfunding

Developers can raise funds for new projects by selling tokenized shares of properties.

Property Management

Tokenization can streamline property management tasks, like rent collection and maintenance, by automating them through smart contracts.

The Future of Tokenized Real Estate Assets

The future of real estate tokenization holds immense promise with increased adoption driven by evolving regulatory frameworks and advancing technology. Anticipated growth in secondary markets will enhance liquidity as more investors engage, while global investment opportunities will allow portfolio diversification across borders. Furthermore, tokenization’s potential for innovative financing models could reshape real estate project funding.

This transformative shift breaks down entry barriers, enhances transparency, and offers inclusive access. Despite challenges, the compelling benefits and opportunities make tokenized real estate assets an enticing prospect for investors and the industry at large. With ongoing technological advancements and regulatory adaptations, the future for tokenized real estate assets appears exceptionally bright.

Recent Posts

Wish to live a culture beyond tech ?

Quick links

Contact

-

INDIA

-

-

-

37B - Thinkvalley , Sector 32 - Gurgaon Haryana - 122002

-

J-2, Jhalana Institutional Area, Jhalana Doongri, Jaipur, Rajasthan 302004

-

Incuspaze Co-Work, 208, 2nd Floor, Apollo Premier, Vijaynagar Square, Indore (MP) 452010

Locations

-

UK

-

-

-

Wework, 33 Queen Street, London, England, EC4R 1AP

-

FZCO IFZA Business Park, Dubai Digital Park, Dubai Silicon Oasis, Dubai, United Arab Emirates

-

Herrgardsvagen 12 A 135 53 TYRESO Sweden

© All Copyright 2022 by FIFTYFIVE TECHNOLOGIES